Impressively simple electronic driver’s log

for individuals, small businesses and large companies with fleets

1 month free trial, after that 15 €/month

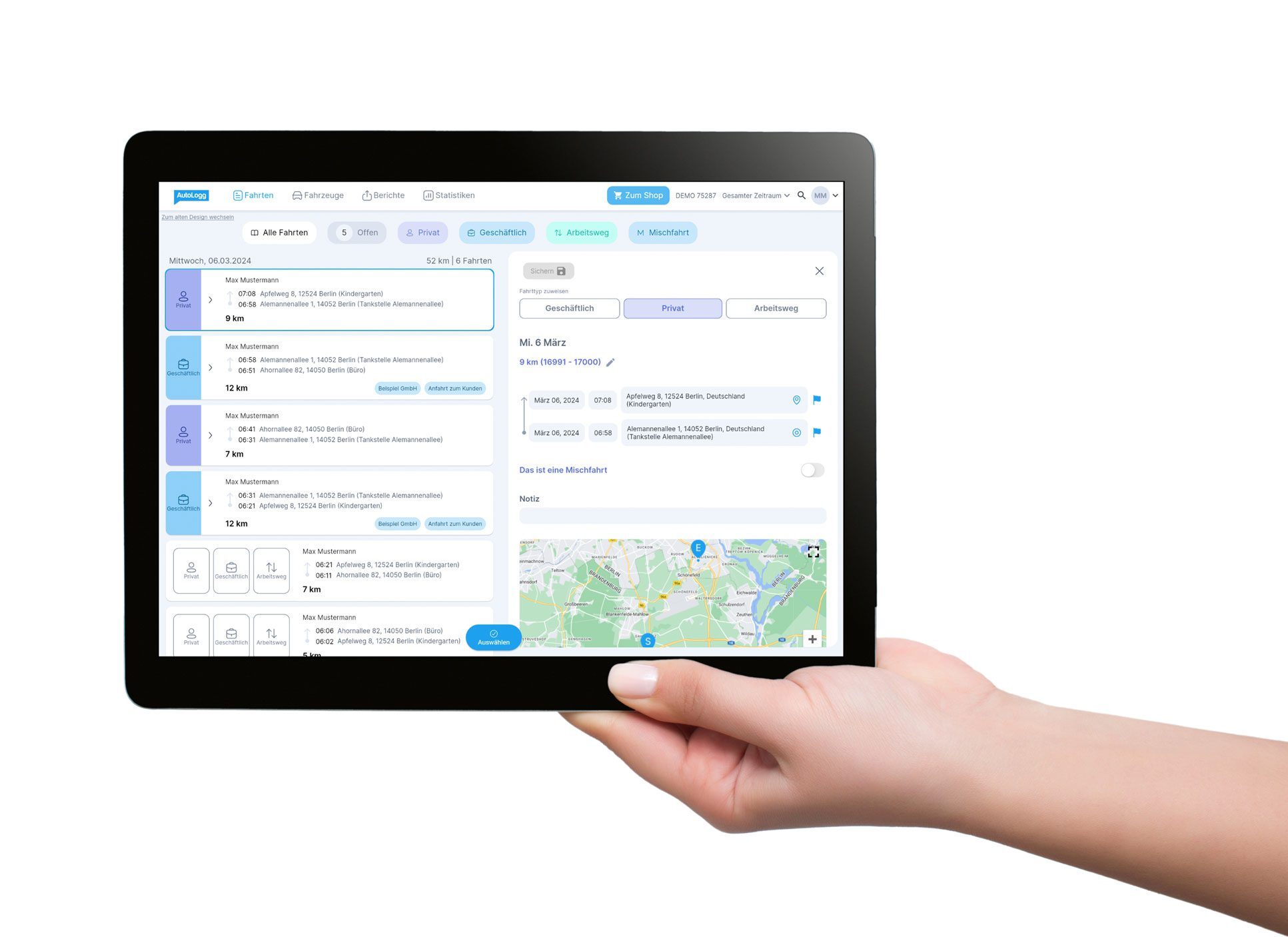

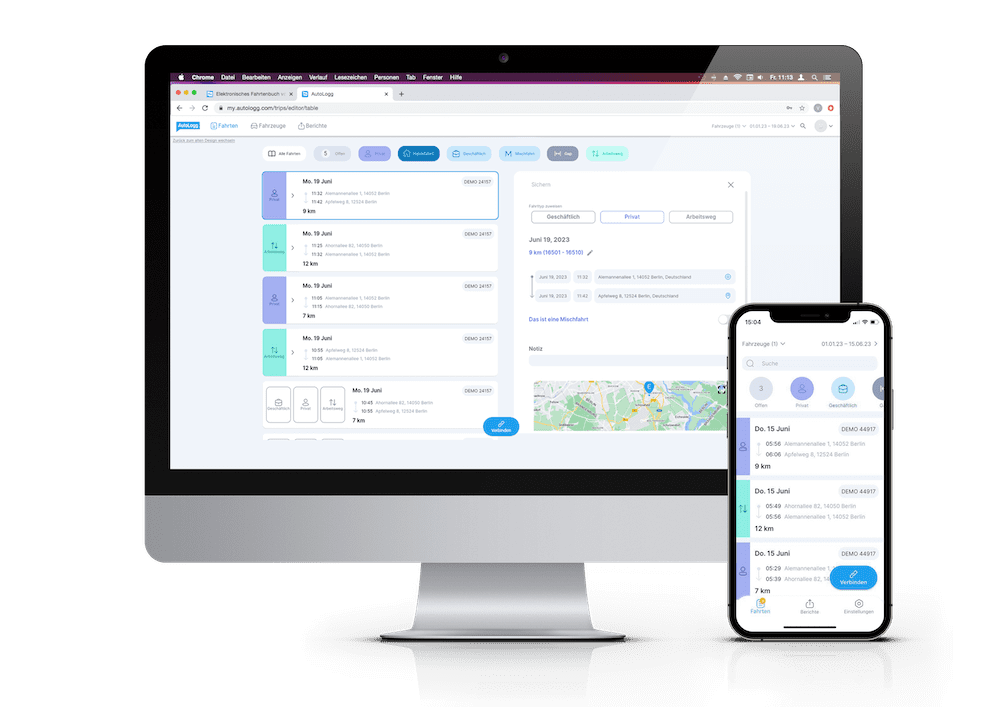

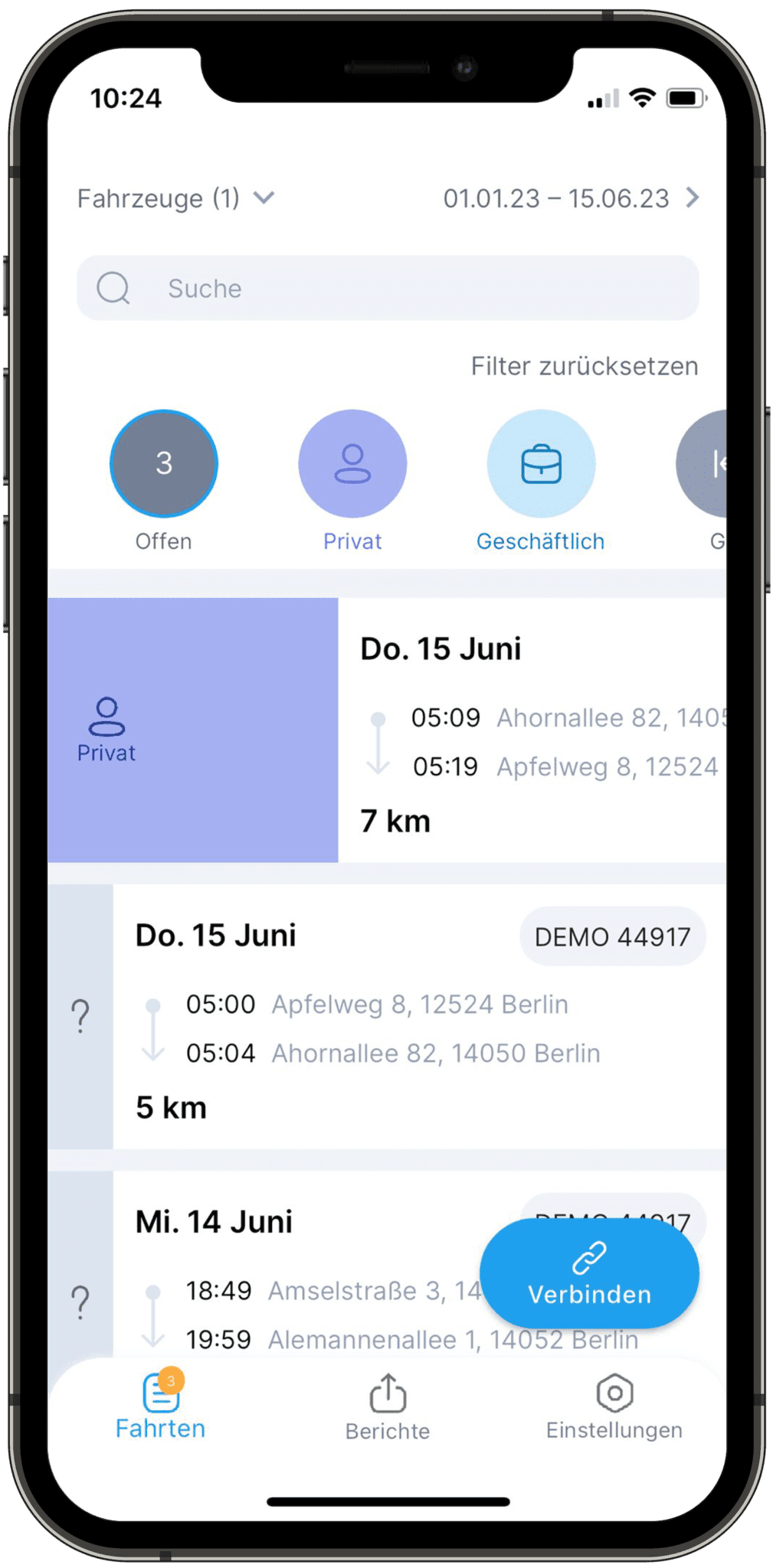

The assignment of your trips

Intuitive editing on PC, smartphone or tablet

Writes itself

like magic

AutoLogg automatically records all trips and remembers previous entries. You’ll be even faster that way.

Easy handling

We already have thousands of happy customers. Our simple and time-saving alternative to paper-based logbooks combines compliant records with intuitive operation.

- Maximum time saving, up to 80%

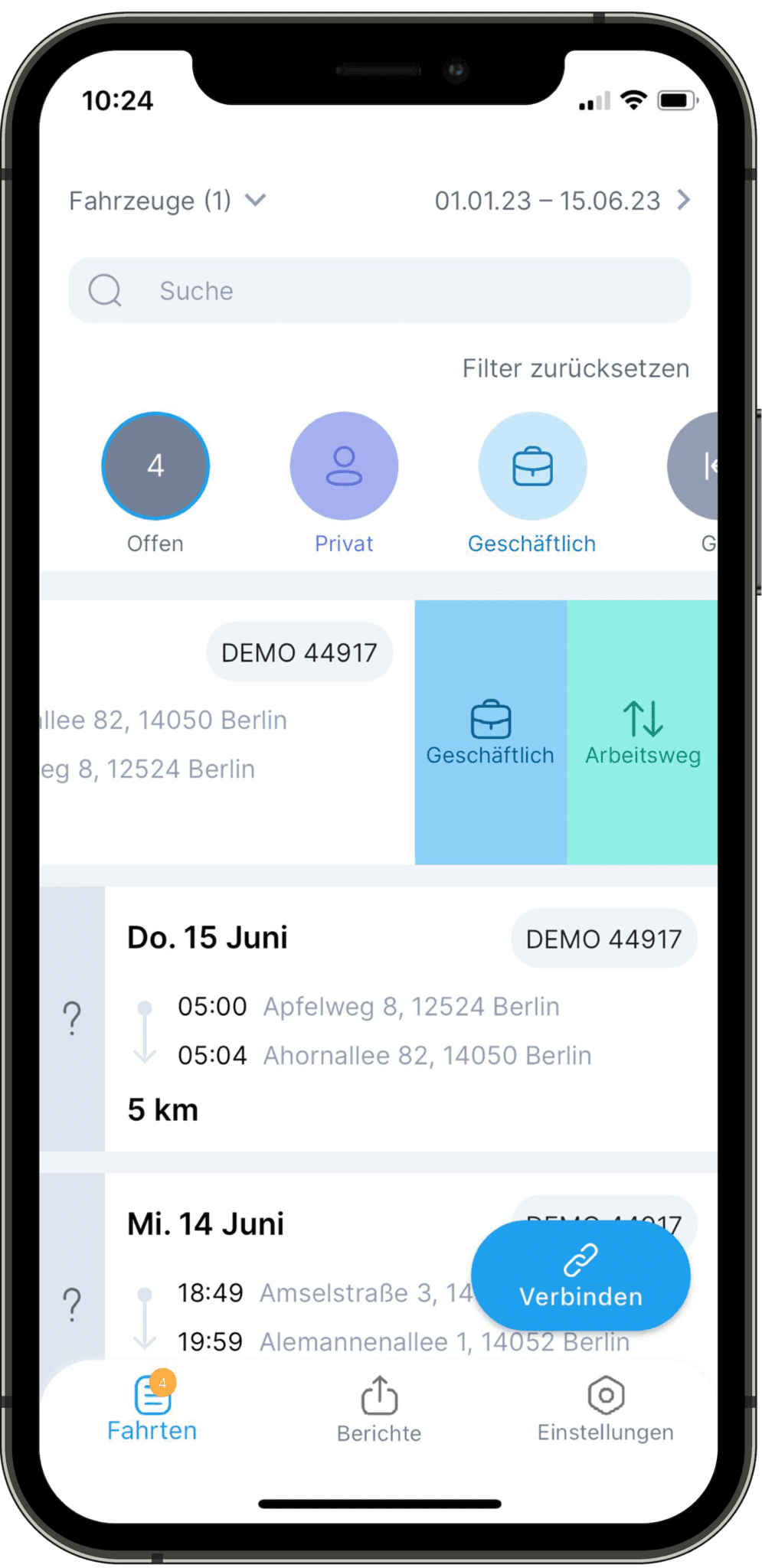

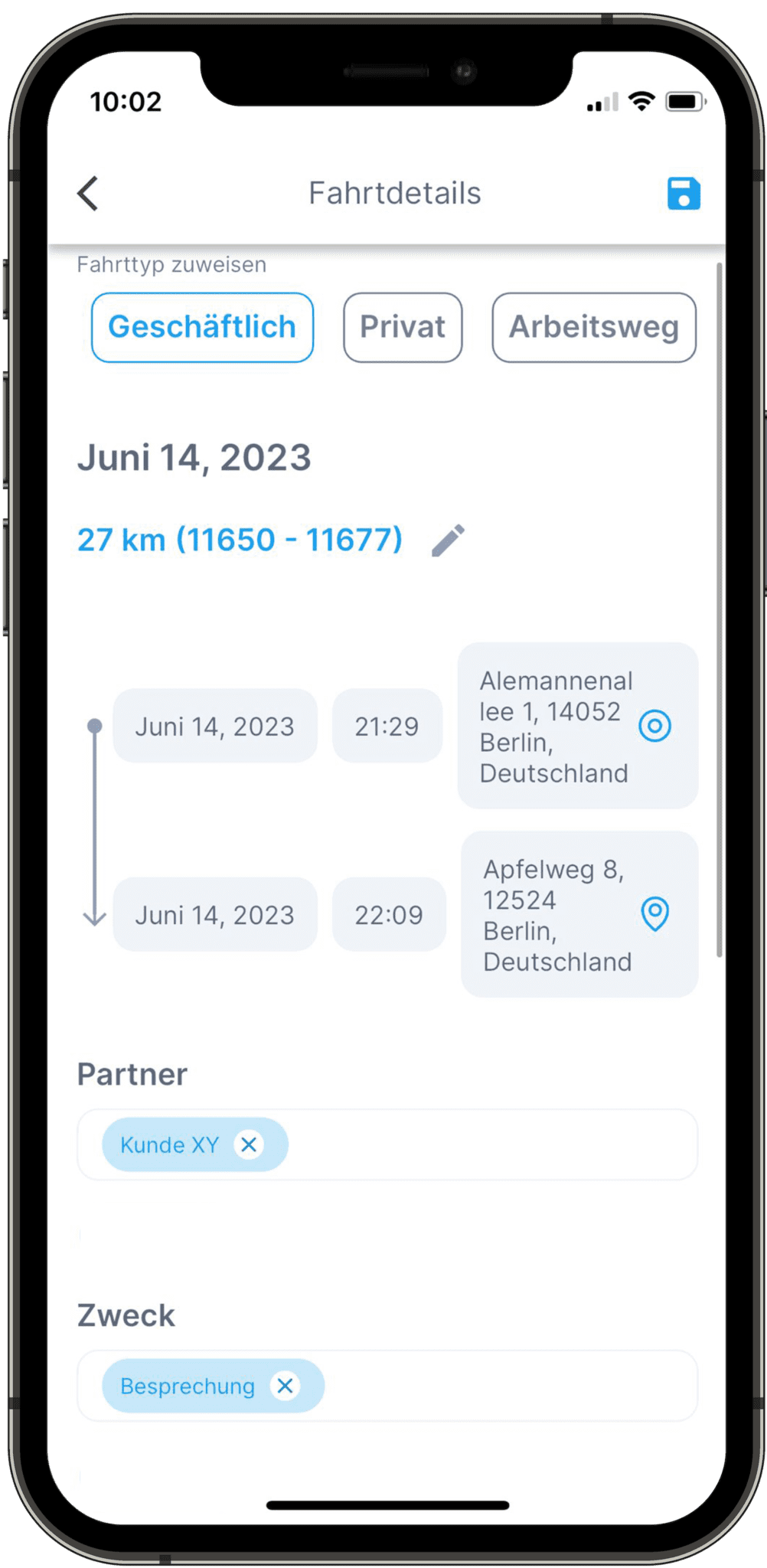

Business trips

Swipe left to assign business trips. Next, partners, purpose, and notes can be added.

Private trips

Swipe to the right to assign a trip to “Private”. Only the start and end mileage appear in the report.

Further information >

Commute

Specify your commute. This information appears in the report in a separate column.

Further information >

Mixed Trips

Split your trips and document detours.

Further information >

Tax office compliant electronic logbook

AutoLogg was developed in close cooperation with tax offices in Germany and Austria. AutoLogg is audit-proof and perfectly adapted to the requirements of the tax authorities for a properly kept driver’s log.

Our digital driver’s log

Developed for tax authorities, recommended by tax consultants.

Our digital logbook solution comes with everything needed and can be put into operation immediately. AutoLogg records all trips automatically. It is not necessary to carry your smartphone.

Recommendations

What our customers say about AutoLogg. Convince yourself of our logbook software and manage your vehicle or fleet with AutoLogg.

“With AutoLogg, I have finally found the perfect partner. I can now recommend a digital driver’s log to my clients with a clear conscience. This not only helps my clients, but also makes my life easier, thanks to the clear PDF export.”

“After an extensive testing period, I was certain that this product would help my clients. Since then, I’ve had countless referrals and I’m happy to have strengthened the collaboration with my customers through the AutoLogg digital logbook.”

“Why did we choose AutoLogg? Simple and stable handling of the system; The group feature makes administration easier for us; Continuous development and releases of new functions; Also very important, the reasonable price”.

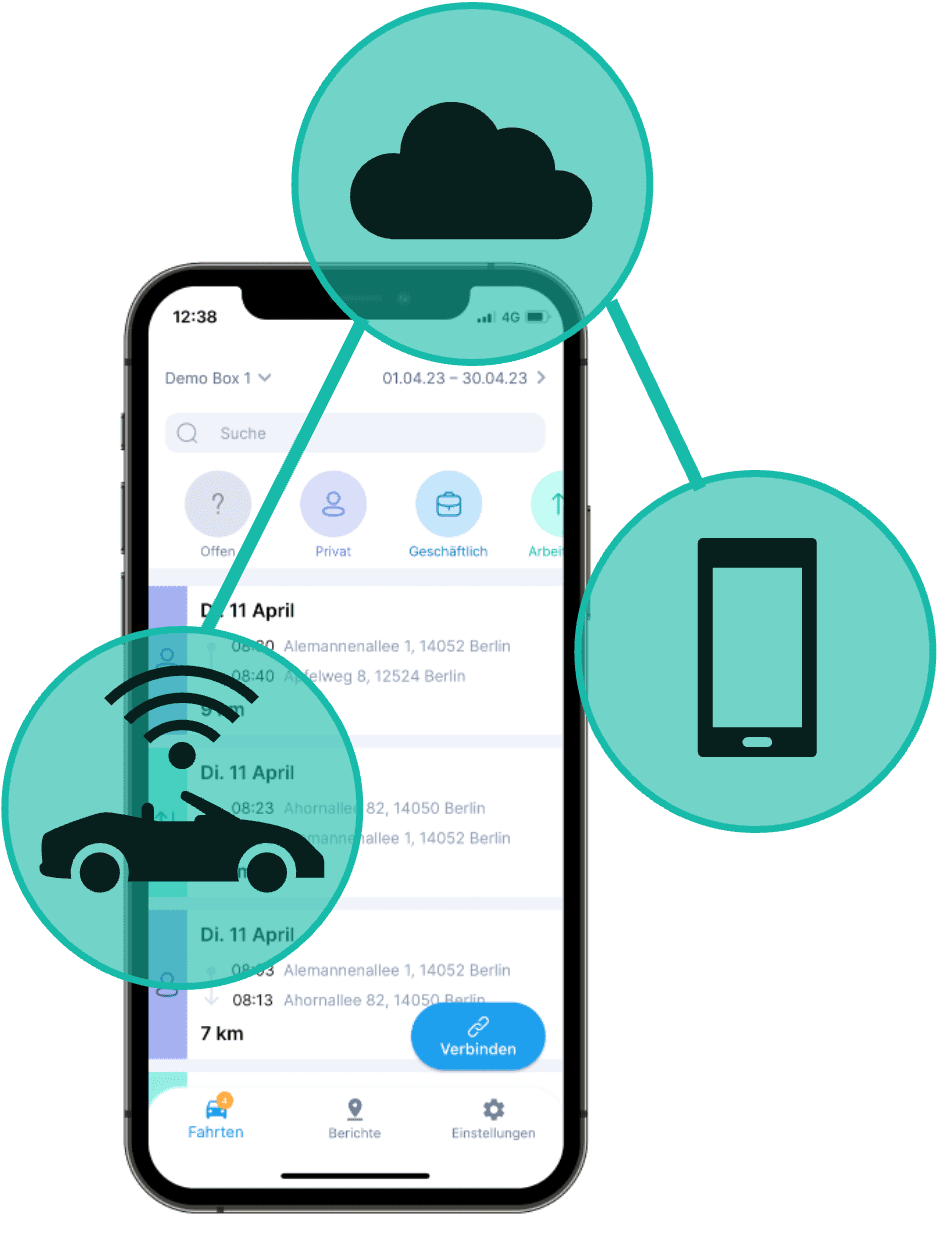

AutoLogg needs a connection

To start the automatic recording of your trips, it is necessary to connect AutoLogg to your vehicle once.

There are two variants:

License Hardware

Via Hardware

Self-installed in seconds. Comes free of charge in the mail after license activation.

License Connected

Directly to the vehicle (BETA)

Available for:

BMW* with active Connected Drive

Ford* with FordPass Connect

Mercedes-Benz* with Connectivity equipment

Porsche* with Porsche Connect

Frequently asked questions

How can I export my driver's log?

You can export your logbook at any time in the AutoLogg web portal at logbook.autologg.com.

We offer you the download of your trips in CSV and PDF. By downloading the CSV you can use the data e.g. for accounting or other evaluations. You can use the PDF download for the tax office.

With which vehicle models is the hardware compatible?

To use the hardware CAN/OBD is required. This is not always the case for vehicles with a production period up to 2008, which is why compatibility with AutoLogg is not possible here.

Please note: Proper functionality of AutoLogg is not possible with the following vehicles:

VW Golf V (y. 2003 – 2008);

VW Sharan (2004–2010);

VW Touran I (Bj. 2003 – 2008);

Audi Q5 (Bj.04/2008-09/2012)

We would like to point out that in exceptional cases it can happen that the exact mileage of certain vehicle batches (due to different control units) cannot be recorded correctly by us via the OBD interface. This is unpredictable, as vehicle manufacturers do not usually make changes to the control units publicly apparent.

Can AutoLogg also be used across borders in Europe?

The availability of AutoLogg in use with the AutoLogg hardware is geographically limited outside Germany and Austria to the reception and transmission range (network coverage) of these countries*:

Belgium, Bulgaria, Denmark, Estonia, Finland, France, French Guiana, Gibraltar, Greece, Great Britain, Guadeloupe, Guernsey, Ireland, Iceland, Isle of Man, Italy, Jersey, Croatia, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Netherlands, Northern Ireland, Norway, Poland, Portugal, Réunion, Romania, Saint-Barthélemy, Saint-Martin (French part), San Marino, Sweden, Slovakia, Slovenia, Spain, Czech Republic, Hungary, Vatican City, Cyprus (Greek mobile network).

If you leave the reception and transmission area, your trips will no longer be transmitted. AutoLogg automatically detects that no reception was possible after returning to an available zone and shows a gap. The gap can be filled in seperately.

AutoLogg Connected (Generation 2.0 – without a hardware) works worldwide.

Tax savings with the driver’s logbook

If the list price of your vehicle is 40,000 euros and you drive an average of 30,000 km with the vehicle, of which 7,500 km (25%) are private. Your way to work is 20 km and the cost of the vehicle is 12,000 euros per year.

Example calculation ![]()

1% method:

| 40.000 (cross list price) * 0,01 (1%-method) | 400 € |

| 40,000 (gross list price) * 20 (km commuting) * 0.0003 (0.03% flat rate commuting) | 240 € |

| To be taxed monthly: | 640 € |

| To be taxed yearly: | 8.400 € |

logbook method:

| 12.000(cost of vehicle)* 0.25(25% private use) | 400 € |

| To be taxed monthly: | 250 € |

| To be taxed yearly: | 3.000 € |

Savings

- 5.400 €

Example calculation ![]()

2% method:

|

40.000 (cross list price) |

800 € |

| To be taxed monthly: | 800 € |

| To be taxed yearly: | 9.600 € |

logbook method:

| 12.000(cost of vehicle)* 0.25(25% private use) | 400 € |

| To be taxed monthly: | 250 € |

| To be taxed yearly: | 3.000 € |

Savings

- 6.600 €

Special regulations apply to electric and hybrid vehicles.

Learn more about this topic here:

Electric and hybrid company vehicles in Germany – Electric and hybrid company vehicles in Austria